UBO requirements of financial free zones of UAE

UBO requirements of financial free zones of UAE

The Ultimate Beneficial Ownership Regulations are implemented in any country as a part of AML/CFT laws. It is one of the recommendations of FATF to control money laundering, terrorism financing, and other financial frauds. UAE also has similar regulations for companies operating in its jurisdiction.

The regulations applicable to companies in mainland UAE do not apply to the financial free zones. These financial free zones have different UBO regulations. These free zones include: Dubai International Financial Center (DIFC) and Abu Dhabi Global Market (ADGM).

Let us look at the key provisions of the UBO regulations in these two free zones:

UBO requirements of DIFC

What is a UBO?

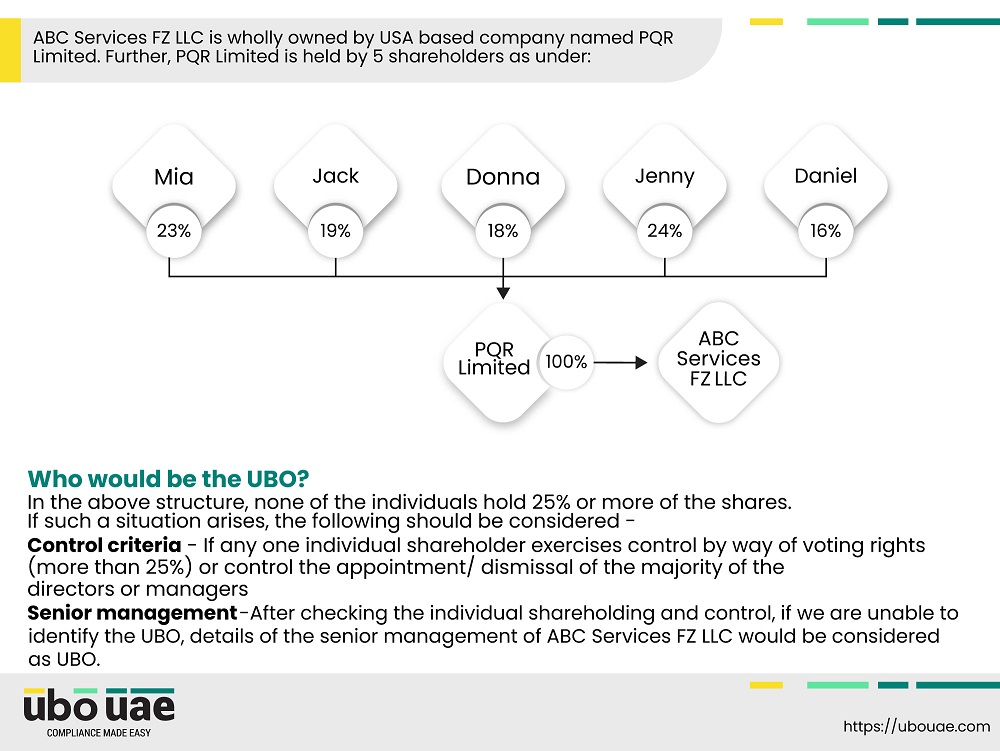

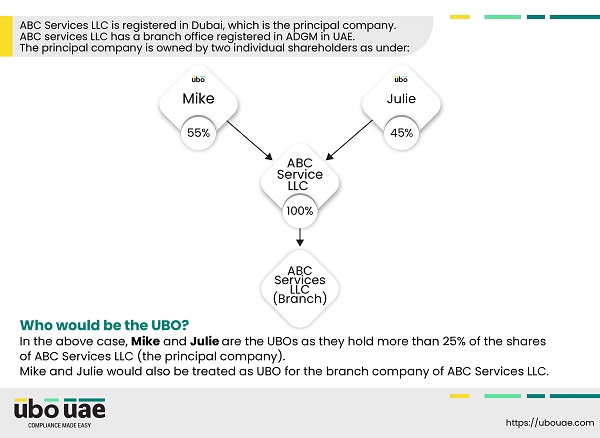

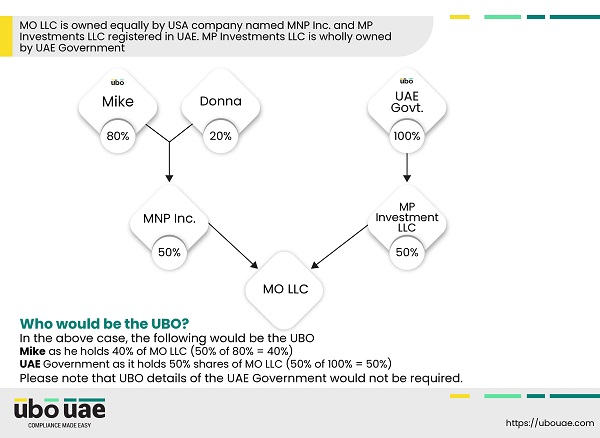

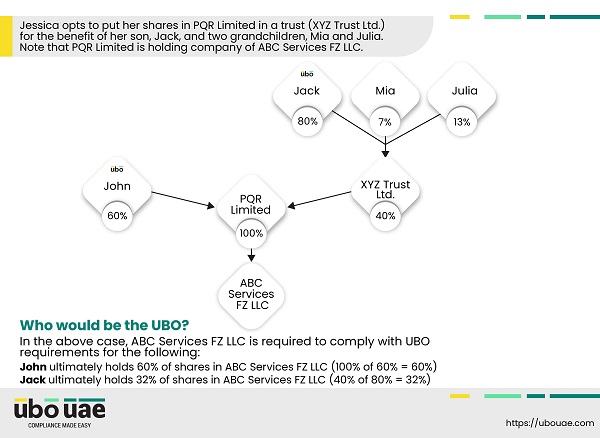

UBO is a natural person who owns or controls, directly or indirectly:

- Shares or other ownership interests of 25% or more in the registered person; or

- Voting rights of 25% or more in the registered person; or

- The right to appoint or remove the majority of the directions of the registered person

- In the case of a partnership, has the legal right to exercise significant control or influence over the activities of the partnership

- In the case of a foundation or non-profit incorporated organization, has the legal right to exercise significant control or influence over the activities of the governing body

If two or more persons satisfy the above conditions, both are UBOs. If no such natural person is identified, then any one of the following is recognized as a UBO:

- Any natural person on whose instructions the registered person is required to act

- A natural person that is a member of its governing body

- UBO of a body corporate member of its governing body

Applicability

DIFC regulations apply to Registered Persons that include companies, partnerships, organizations, foundations, Registrar, and any other person as stated by the Regulation in DIFC.

It does not apply to a registered person that is:

- Wholly owned by a government or government agency in UAE

- Established under the Federal or Emirates law of UAE to perform governmental functions

- Regulated by DFSA or any other Recognized Financial Services Regulator

- Having securities listed or traded on a Recognized Exchange

- Subject to comparable international standards in its home jurisdiction and proves that it submits similar information in its home jurisdiction

- Non-profit Incorporated Organization that does not operate in activities such as raising or disbursing funds for social, charitable, fraternal, cultural, educational, and religious purposes

If entities are exempted from the DIFC law, the relevant authority will conduct an assessment to determine whether the qualification for exemption is correct or not.

If a person meeting any of the exemption criteria mentioned above beneficially owns or controls 25% or more in a DIFC entity, the latter can qualify for partial exemption.

UBO Requirements

Every registered person must obtain, maintain, and hold a private Beneficial Ownership Register. It must file the UBO details with the Registrar of Companies on the DIFC portal. The entity must include the following particulars of its Ultimate Beneficial Owners/s in a private Beneficial Ownership Register:

- Full legal name

- Registered address

- Date of birth and place

- Nationality

- Passport details or any other government ID details (number, date of issue, date of expiry, and country of issue)

- The date on which the person became a UBO and ceased to be a UBO

In case of partial exemption, the DIFC entity must maintain a Beneficial Ownership Register. This UBO Register UAE will have the following information:

- Full legal name

- Address of shareholder

- Category of exemption

- The name of the recognized exchange on which it has its securities listed or traded

- The name of the regulator if a recognized financial services regulator regulates it

- The name of the relevant jurisdiction where it is wholly owned by the government or government agency

- The name of the law of UAE under which it is licensed to perform governmental functions

Additional information

When the regulations were introduced on November 12, 2018, the companies were given a deadline to comply. After this, whenever a new entity is incorporated in DIFC, it must create a Beneficial Ownership Register within 30 days of its incorporation.

When there is a change in UBO/s or their particulars, the DIFC entity must update the Register. Entities have a period of 30 days to update the Register and 30 days to notify the Registrar of the same. A registered person failing to meet the UBO requirements is fined a penalty of US$25,000.0.

Entities can maintain the Register electronically only if they ensure to make it accessible always at the registered address, especially when DIFC carries out inspections.

Suppose a registered person is in the process of being wound up or dissolved. In that case, the liquidator or any other person responsible for liquidation shall provide the Beneficial Ownership Register to the Registrar within 30 days of being appointed. A similar process is to be followed in the case of a strike off from the Public Register by the members of the governing body. The Registrar must keep this information for a maximum of six years.

If the Registrar becomes aware of a situation wherein:

- The UBO is sanctioned by the government, national entity or supra-national entity, or

- There are criminal, civil, tax, administrative, or regulatory proceedings against the UBO

And, if this is prejudicial to the interests of DIFC, the Registrar can send a notification to the entity to remove that UBO.

Nominee requirements

Similarly, a nominee director must inform the entity that it’s a nominee and provide relevant particulars. The nominee director must send these particulars within 30 days of becoming a nominee or the incorporation of the entity.

An entity with more than one nominee director must maintain a Register of Nominee Directors, which must have all the particulars of nominee directors as in the Beneficial Ownership Register. In the case of liquidation or strike off from the Public Register, the same provisions apply as in the case of the Beneficial Ownership Register.

Make yourself UBO Compliant With UBO UAE’s assistance

UBO requirements of ADGM

Who is a beneficial owner?

In the context of a company or LLP, beneficial owner means:

- Any person who owns or controls 25% or more of the shares or voting rights in the entity, directly or indirectly

- Any person who controls the entity:

- In the case of an LLP, the person holds more than 25% of the voting rights in the conduct and management of the entity

- In the case of a company, the person holds more than 25% of the shares or voting rights or the right to appoint or remove a majority of the board of directors of the company, directly or indirectly

- Any person who exercises control over the management of the entity

In the case of a partnership entity, a person who is entitled to or controls more than 25% share of the capital or profits of the partnership or more than 25% of the voting rights, directly or indirectly, is a beneficial owner.

A listed company, a company wholly owned by the Federal or Emirate government, or a company created by the Emiri decree within UAE can also be a beneficial owner.

Who is a beneficial owner?

In the context of a company or LLP, beneficial owner means:

- Any person who owns or controls 25% or more of the shares or voting rights in the entity, directly or indirectly

- Any person who controls the entity:

- In the case of an LLP, the person holds more than 25% of the voting rights in the conduct and management of the entity

- In the case of a company, the person holds more than 25% of the shares or voting rights or the right to appoint or remove a majority of the board of directors of the company, directly or indirectly

- Any person who exercises control over the management of the entity

In the case of a partnership entity, a person who is entitled to or controls more than 25% share of the capital or profits of the partnership or more than 25% of the voting rights, directly or indirectly, is a beneficial owner.

A listed company, a company wholly owned by the Federal or Emirate government, or a company created by the Emiri decree within UAE can also be a beneficial owner.

Applicability

An ADGM person can be a company, LLP, foundation or trustee as per the ADGM laws.

The following legal entities are exempt from these Regulations:

- Public listed companies

- Government entities in UAE

- Branches of foreign companies or partnerships

Requirements

Each ADGM person must find out the true identity of its beneficial owners. It must keep a record of the following particulars of its beneficial owners in a document called ‘The Record of Beneficial Owners’:

In respect of a natural person:

- Full name

- Country of residence

- Nationality

- Occupation

- Date of birth

- The date of becoming a beneficial owner and reasons for the same

In the case of an ADGM person that is not a natural person:

- Registered name

- Registered address

- Registration number

- Country of registration

- The date on which the person became a beneficial owner

If no persons meet the above criteria, the ADGM person must mention the same in the Record of Beneficial Owners. The ADGM person must make changes to the Record within 30 days as and when they occur to keep the Record updated. It must notify the Registrar of the change within 30 days. The ADGM person must submit a copy of this Record to the Registrar within 30 days of making it.

Additional information

If the ADGM person is dissolved, terminated, or struck off, the liquidator or any person responsible for handling the dissolution process must retain the Record of Beneficial Owners for six years. It must submit the same to the Registrar.

If the ADGM person fails to comply with any of the requirements under this law or provides wrong information in the Record, it would be fined US$25,000.0.

Conclusion

Compliance with UBO regulations is essential for entities in both DIFC and ADGM. Failure to comply with it invites fines in both the free zones. So, maintain the registers, provide accurate information, and submit them to the Registrar whenever requested.

If you need external help, then UBO UAE is always there to make you UBO compliant. We are a leading UBO compliance services provider in UAE that can handle all relevant compliance activities for UBO. We can:

- Assess whether you qualify for UBO or are exempt

- Collect all the necessary information about your beneficial owners

- Make changes whenever necessary and notify the Registrar of the same

- Maintain a Register or Record of beneficial owners at your office

- Liaise with the relevant authorities for UBO compliance

Our Recent Blogs